NEW YORK — Although obstacles to a widespread rollout remain, CBD products are edging into the mainstream.

Late last month both CVS Pharmacy and Walgreens announced that they would begin selling CBD products in some stores.

CVS has begun carrying CBD products in selected stores in seven states: California, Colorado, Illinois, Indiana, Kentucky, Maryland and Tennessee.

The chain is stocking hemp-derived topical products only, such as creams, sprays, roll-ons, lotions and salves, according to a company spokesman. CVS said it will not sell any supplements or food additives containing CBD.

The chain is stocking hemp-derived topical products only, such as creams, sprays, roll-ons, lotions and salves, according to a company spokesman. CVS said it will not sell any supplements or food additives containing CBD.

“Were going to walk slowly,” CVS Health president and chief executive officer Larry Merlo said in an interview on CNBC. “But we think that this is something that customers are going to be looking for as part of the health offering.”

Walgreens said it will sell CBD creams, patches and sprays in nearly 1,500 stores in Oregon, Colorado, New Mexico, Kentucky, Tennessee, Vermont, South Carolina, Illinois and Indiana.

“This product offering is in line with our efforts to provide a wider range of accessible health and well-being products and services to best meet the needs and preferences of our customers,” Walgreens spokesman Brian Faith said in an email.

If more mass retailers begin carrying CBD products, they will likely change where consumers buy them, while also raising the visibility of the category.

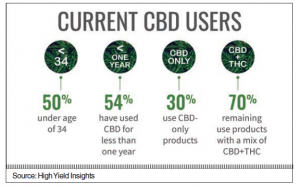

Currently most users of CBD products are buying them online or from licensed cannabis dispensaries, according to a report from High Yield Insights, a Chicago-based market research firm that specializes in the cannabis industry.

“As of today, the purchase channels for CBD consumers are very fragmented,” said High Yield Insights cofounder Mike Luce. “But this is largely a by-product of the heavily regulated and hazy environment in which CBD has operated. Following the Farm Bill and with clearer direction from the FDA, we expect to see more mainstream stores start offering shoppers CBD options.”

Luce added that High Yield Insight’s research indicates that consumers are seeking easier access to CBD products.

“Easier access ranked just below lower prices as a driver for more regular use for current users and likelihood to try CBD, in the case of potential users,” Luce said. “Seeing CBD products alongside of other health and wellness solutions in large chain stores seems like something most consumers would welcome.”

High Yield Insight’s report on the CBD consumer experience finds that current users of CBD products see them as the solution to a wide range of health and wellness challenges, from pain management to sleeplessness and anxiety. The study found that 80% of CBD users agree that cannabis can address physical health conditions, 79% of CBD users agree that it can address mental health conditions, and 83% believe it can improve overall health and wellness.

The study also found that roughly 40% of U.S. adults have indicated a willingness to try CBD under the right circumstances. Most of those potential CBD users are age 35 or older (64%), are female (56%) and have some college education (79%). Also, most live in states where cannabis has some form of legal availability, with medical-use states being particularly strong indicators of interest in CBD. States with no legal program for cannabis use will be difficult for the CBD industry to convert, the report contends, but the wave of legalization that is taking place could dramatically boost the market for CBD products.

That finding is in line with the conclusion of a study that A.T. Kearney did in October, which polled 1,000 Canadians (at the time when that country was legalizing cannabis) and 1,000 consumers in the United States. Seventy-five percent said they would be open to trying various cannabis-infused products.

You must be logged in to post a comment Login