ACSI scores show declines in several categories

ANN ARBOR, Mich. — Retailers have struggled to deliver outstanding customer service during the COVID-19 pandemic, according to a new study by the American Customer Satisfaction Index (ACSI.)

“From the onset of COVID-19, consumer expectations of retailers took a massive hit,” ASCI managing director David VanAmburg said. “Customers braced for delayed packages, empty grocery store shelves, and hard-to-find name brands. Of course, just because they expected this, doesn’t mean they were thrilled about it. As customer satisfaction slips, retailers must adapt to the new market. It’s clear they have their work cut out for them.”

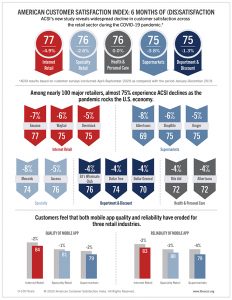

Four out of five retail industries ACSI tracks — department and discount stores, specialty retail stores, supermarkets, and internet retailers — saw their customer satisfaction scores slip during the pandemic. Internet retailers collectively saw the biggest decline. According to ACSI’s special COVID-19 retail study, based on surveys collected from April 1 to September 30, internet retailers posted an ACSI score of 77. That is down 4.9% from their score in ACSI’s 2019-2020 Retail Report.

Even so, that score of 77 kept internet retailers ahead of other retail categories. Specialty retail stores (down 2.6%) and drug stores (unchanged) tied for second at 76, while department stores (down 1.3%) and supermarkets (down 3.8%) both scored 75.

Even so, that score of 77 kept internet retailers ahead of other retail categories. Specialty retail stores (down 2.6%) and drug stores (unchanged) tied for second at 76, while department stores (down 1.3%) and supermarkets (down 3.8%) both scored 75.

In the ratings for specific internet retailers, Amazon saw the biggest decline in customer satisfaction, according to the ACSI report. Its score fell 7% to 77. Costco, Etsy, and Nordstrom tie among internet retailers with a score of 80, but Costco’s score slipped by 1%, while the other two saw their scores fall by 2%.

Tied with Amazon among at 77 were Staples (unchanged), Best Buy (down 1%), Target (down 1%), eBay (down 3%) and Macy’s (down 4%). Home Depot (down 3%) and the group of “other internet retailers” (down 4%) each scored 76, followed closely by nine retailers at 75: Walgreens (unchanged), GameStop (down 1%), Groupon Goods (down 3%), Gap (down 4%), Dell (down 4%), Apple (down 4%), Lowe’s (down 4%), Overstock (down 5%), and Wayfair (down 6%). Walmart (down 1% to 73) and Sears (down 1% to 72) rounded out the list in the internet retailers category.

In the department and discount stores category, Costco took the top spot with an ACSI score of 81 (down 2%). Costco improves for its mobile app quality and reliability; however, satisfaction with inventory falls sharply.

Tied for second place at 79 are: Kohl’s (unchanged), Nordstrom (unchanged), Dillard’s (up 1%), Belk (up 1%), and Walmart’s Sam’s Club (down 2%).

Macy’s comes in third, unchanged at 78, followed by JCPenney, which slides 1% to 77. Target (down 3%), BJ’s Wholesale Club (down 4%), and the group of smaller department stores (down 4%) all tie at 76. Meijer and Ross Stores each slip 1% to 75. Dollar Tree fell 4% to 74 and Sears improved 4% to hit that same score.

Big Lots held steady at 73, followed by Fred Meyer (down 3% to 72), Walmart (stable at 71) and Dollar General (down 4% to 70).

Overall, department and discount stores improved in terms of store layout, checkout speed, name brands, store locations, and mobile app reliability. However, customers feel the industry struggles with inventory availability, sales and promotions, and store hours since COVID-19, with the latter dropping 2% to 80.

Among grocery retailers, Trader Joe’s and Wegmans tied for first place at 84, followed by Publix and Costco at 83. Customers are increasingly satisfied with Costco’s checkout speed these past six months.

Texas-based grocer H-E-B climbed into a tie for first place in the 2019-2020 Retail report, but lost ground since the pandemic, falling 2% to 82.

Walmart’s Sam’s Club was unchanged at 80, tying it with Aldi (down 4%), and just ahead of BJ’s Wholesale Club, which fell 4% to 79. Hy-Vee remained steady at 78, while three grocers scored 76: Ahold Delhaize (down 1%), Target (down 4%) and Amazon’s Whole Foods (down 4%).

Five grocers scored 75: Save-A-Lot (unchanged), Supervalu (down 1%), Meijer (down 4%), Kroger (down 5%), and ShopRite (down 6%). Scoring 74 were Southeastern Grocers (down 3%), Giant Eagle (down 3%). Walmart’s score in this category fell 3% to 71, and Albertsons Cos. scored 69.

Supermarkets as a whole were rated as steady on checkout speed, but slipping in other customer experience benchmarks, including the number of sales and promotions, and the ability to stay in stock.

The health and personal care store category remained steady with an ACSI score 76. Smaller drug stores collectively led the industry with a score of 81 (down 1%), followed by CVS (up 1% to 78). Kroger, which saw its rating slip 1% to 77, was next, followed by Walmart, up 1% to 75. Walgreens saw its rating slip 3% to 73, and Rite Aid and Albertsons Cos. each saw their ACSI scores fall 4% to 72.

Customer experience for drug stores as a whole remained mostly steady during the past six months, according to the study. Customers rated the checkout process (up 1% to 77) as faster and mobile app reliability (up 2% to 83) as better. The industry’s score on the ability to provide name brands declined 1% to 78.

The American Customer Satisfaction Index special COVID-19 retail study is based on interviews with 30,787 customers conducted from April 1 to September 30 of this year.

You must be logged in to post a comment Login