Report: successful brands focus on wellness, convenience

CHICAGO — IRI, a global leader in innovative solutions and services for consumer, retail and media companies, announced Wednesday the release of its 2018 New Product Pacesetters, its 23rd annual report, highlighting the most successful new product launches across food and beverage, non-food and convenience store sectors. Smaller companies continue to dominate the list, and the most successful products emphasize wellness and convenience. Among food companies, indulgence is in, taking the top two spots. Within the non-food sector, beauty products bested other categories, with 28 products achieving Pacesetter status, while enhanced laundry products held the number one and four positions.

“The majority of 2018 New Product Pacesetters addressed at least one of the overriding themes we’ve observed over the past few years,” says Joan Driggs, vice president, content and thought leadership, IRI. “They’re upping the consumer experience, delivering against expectations and addressing simplicity, either with ingredients, convenience or sustainability.”

Products from Smaller Companies Top 50% for the First Time

For the first time, products developed by companies with annual revenues under $1 billion represented the majority of top-ranking brands, accounting for 51% of the products listed and representing 27% of Pacesetters revenues. Companies with sales between $1 billion and $5 billion continued to have declining representation, responsible for just 27% of products and 19% of revenues, as compared to 35% and 26% five years ago, respectively. Larger companies, those with more than $5 billion in revenues, accounted for just 22% of Pacesetters products but 54% of Pacesetters sales.

For the first time, products developed by companies with annual revenues under $1 billion represented the majority of top-ranking brands, accounting for 51% of the products listed and representing 27% of Pacesetters revenues. Companies with sales between $1 billion and $5 billion continued to have declining representation, responsible for just 27% of products and 19% of revenues, as compared to 35% and 26% five years ago, respectively. Larger companies, those with more than $5 billion in revenues, accounted for just 22% of Pacesetters products but 54% of Pacesetters sales.

Winning companies are growing dollar sales based on an enhanced understanding of consumer wants and needs, capturing adjacent white space and/or acquiring companies that have a demonstrated strength in a particular niche.

Total Pacesetter sales dollars declined between 2012 and 2018 by $3.4 billion, however, total IRI-measured multi-outlet channels (not including convenience store) sales grew 1.7% in 2018, following increases of 1.2% in both 2017 and 2016. This reflects improved understanding of consumer behaviors, which results in consumers remaining interested in new product products longer. Sales momentum that in the past would often dissipate after year one now continues into year two and beyond. Among 2017 Top 10 New Product Pacesetters, seven of the top 10 maintained or increased sales in year two.

Total Pacesetter sales dollars declined between 2012 and 2018 by $3.4 billion, however, total IRI-measured multi-outlet channels (not including convenience store) sales grew 1.7% in 2018, following increases of 1.2% in both 2017 and 2016. This reflects improved understanding of consumer behaviors, which results in consumers remaining interested in new product products longer. Sales momentum that in the past would often dissipate after year one now continues into year two and beyond. Among 2017 Top 10 New Product Pacesetters, seven of the top 10 maintained or increased sales in year two.

“Two driving forces are reshaping the CPG landscape and are deeply reflected in this year’s New Product Pacesetters,” said Larry Levin, executive vice president, market and shopper intelligence, IRI. “Ecommerce is driving home to consumers the value of convenience and shoppers now expect convenience in the products themselves, in addition to how they purchase them and have them delivered. Second, artificial intelligence (AI) and machine learning (ML) are arming manufacturers and retailers with new insights into consumers’ wants and needs, resulting in a new wave of products that capture shoppers’ initial interest and maintain that interest over the longer term.”

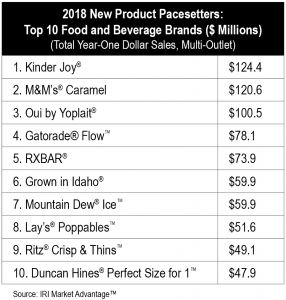

Food and Beverage Leaders Concentrate on Indulgence

For consumers with a sweet tooth, 2018 was their year. Ferraro USA’s Kinder Joy and Mars’ M&M’s Caramel achieved first and second place status, respectively, with sales of $124.4 million for Kinder Joy and $120.6 million for M&M’s Caramel. In fact, five of the top 10 Food and Beverage Pacesetters featured sweet or savory indulgence. Health and wellness were also well represented with products including Oui by Yoplait and RXBAR, a protein bar, joining the list at number three and number five, respectively. Lay’s Poppables highlighted healthier manufacturing by baking versus frying and Duncan Hines Perfect Size for 1 is an excellent example of portion-controlled indulgence, coming in at number 10.

For Non-food Leaders, Is Folding Laundry Next?

Laundry product manufacturers continue to bundle new ingredients and benefits into these products, is self-washing and self-folding next? Tide Ultra Oxi led the 2018 Pacesetters non-food category with $139.8 million in sales and Tide Pods Plus Downy held down the number four position.

Laundry product manufacturers continue to bundle new ingredients and benefits into these products, is self-washing and self-folding next? Tide Ultra Oxi led the 2018 Pacesetters non-food category with $139.8 million in sales and Tide Pods Plus Downy held down the number four position.

Beauty care products also featured prominently among this year’s Non-Food New Product Pacesetters. In addition to 28 beauty products achieving Pacesetters status, three were in the top 10: Idea Village’s Finishing Touch Flawless took the number seven position with $68.4 million in first year sales, Unilever’s Love Beauty and Planet with $62.3 million was number eight and the ninth position was taken by L’Oreal Voluminous Lash Paradise with $60.5 million.

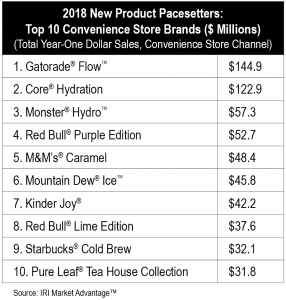

Hydration Quenches the Thirst for Growth in Convenience

Beverages are clearly the growth driver in convenience, taking eight of the top 10 spots in this year’s New Product Pacesetters. Pepsi products earned the number one, six and 10 positions (number 10 in partnership with Lipton), and Red Bull held two spots.

Consumers turn to the convenience channel for a boost, three of the top 10 products were energy drinks, and four other products include stimulants; two chocolate candy products, one ready-to-drink coffee and one ready-to-drink tea.

You must be logged in to post a comment Login