A classic retail success story spanning nearly six decades

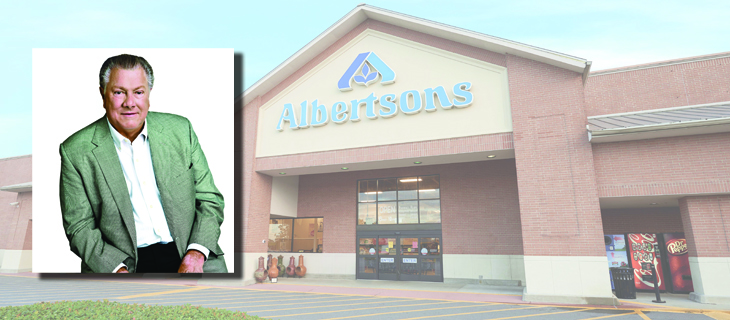

Albertsons chairman Bob Miller

BOISE, Idaho — Bob Miller brought another chapter in his storied retailing career to a close last September when he stepped down as chief executive officer of Albertsons Cos. Asked how closely Jim Donald, his successor at the food, health and wellness retail store operator, would follow his example, Miller said, “He’s got to have his own path to success.”

Miller knows what he’s talking about, having put that principle into practice over the course of almost six decades in the industry. Originally hired by All-American Grocers to sort bottles while still in high school, he went on to hold leadership positions at several top-tier retailers, including Albertson’s Inc., Fred Meyer Inc., Kroger Co. and Rite Aid, before taking Albertsons Cos. from a private equity-backed startup in 2006 and making it into the second-largest supermarket operator in the United States. In light of Miller’s achievements at Albertsons Cos. and sustained record of excellence, the editors of Mass Market Retailers have honored him with the publication’s Lifetime Achievement Award.

In many respects, Miller’s is the classic retail success story. After humble beginnings as a bottle sorter, he almost immediately started to move up the ladder, in rapid succession serving as a box boy, stock clerk, deli manager and store director. That experience set the pattern for his career, which then took him to Albertson’s Inc., where, following various peregrinations, he rose to become executive vice president of retail operations, the No. 3 job in the company.

Miller’s big break came in 1991 when he was chosen by investment firm Kohlberg Kravis Roberts to run Fred Meyer, a multidepartment store retailer operating in several western states. He jumped in and set about transforming the publicly traded company (in which KKR had a 40% stake) and, in the process, developed many skills that held him in good stead.

“The biggest adjustment for me was being CEO,” Miller recalls. “I had been kind of like the chief operating officer of a grocery company, but I didn’t know anything about Wall Street, or finances, or any of that stuff, and Fred Meyer was in trouble.

“They were generating enough money to pay their debt, and had just a little bit of capital to spend. The first year I really tried to get involved in the balance sheet. I had to learn a lot.”

Miller concluded that Fred Meyer’s stock was undervalued because investors didn’t understand the store format. To attain the higher multiples enjoyed by supermarkets at the time, he set about acquiring a series of grocers in the western U.S., including Smith’s Food and Drug, Ralph’s and QFC. The moves, which helped make Fred Meyer the second-largest food retailer in the country, gave the company the financial wherewithal to retool its business and take on new competitive challenges.

“We changed a lot,” Miller says. “When I arrived, the departments ran all their businesses independently. In other words, the apparel manager reported to the apparel regional manager; they had five managers in a store all reporting up. We put a store director in every location and completely changed the structure, and also unified the technology platform.

“We developed a new strategy. Just as I got to Fred Meyer, Walmart was starting to build discount stores in the Pacific Northwest. We responded by deciding that we were going to carry better merchandise. We had a much different product mix than Walmart, and that really, really helped Fred Meyer succeed.”

The strong results of the company didn’t go unnoticed, and in 1999 rival Kroger acquired Fred Meyer for $13 billion, at the time the highest price ever paid for a grocery company. Miller stayed on as Kroger vice chairman for less than a year, before being asked to rescue Rite Aid, the nation’s third-largest drug chain, from the precipice of Chapter 11.

“I got a call from a friend of mine, John Sokoloff, of Leonard Green and Partners,” Miller recalls. “They had invested in Rite Aid, and he said that they really needed somebody to help them. Could I do it for at least a year and see what’s going on there, and I finally said OK. I went to Rite Aid with a team, and the company was going bankrupt. We worked hard and got that fixed.”

What Miller — who served as the drug chain’s chairman and CEO from December 1999 until June 2003, and retained the former position until June 2007 — and his colleagues found was a company wracked by criminal financial mismanagement.

“We worked with a lot of different people to turn things around,” says Miller. “But No. 1, we got a new team in there to run the stores better and start trying to make a little money. We slowed down the growth. They were trying to build 500 stores a year, and they were all losing money, so we cut that off pretty quickly.

“We also worked with some of the big banks in New York to refinance Rite Aid’s debt. We had a bank loan that was due right away, a billion dollars, with 37 banks involved in a syndicate. In order not to go Chapter 11 we had to have a plan in place and convince 37 bankers to extend the credit line, and let us see if we can fix it.”

The credibility with the financial community that Miller had earned in his previous roles was crucial in winning over the banks. “The best way to work with Wall Street is to always tell the truth, the bad along with the good,” he explains. “Other people might have a different philosophy, but otherwise it always comes back to haunt you eventually.” Miller met with executives at 30 of the 37 financial institutions personally, and convinced them that “we can fix it if you give us time. That’s what we did, and it was all retail basics.”

The culmination of Miller’s career was his catalytic role in the emergence over the past dozen years of Albertsons Cos. as a retail powerhouse.

“When we took this company over, I understood that my investors had bought it because of the real estate value,” explains Miller. “When I came to work here, I said ‘Well, I’ll run it, but I’m going to run it to try to save the stores and the jobs for the people who work there.’ The investors agreed. From then on it was get up in the morning and run good stores, try to make a little money, treat people right, and all of a sudden things are happening.”

Working with a foundation of the 661 supermarkets passed over by other buyers after the breakup of Albertson’s Inc., Miller and his team started by making Albertsons Cos. profitable. After divesting many locations in order to reduce the debt and improving operations at the remaining stores (Miller notes that he was particularly pleased with the strong performance in the company’s two toughest markets, Texas and greater Phoenix), Albertsons Cos. reached a crossroads.

“We were four years into this, and had we paid off all our debt,” Miller says. “We had sent our investors a bunch of money, and we had this nice little company doing about $4 billion a year in revenue and making money. So we had to decide what we wanted to do with it. Personally, I would have liked to just run the company, because nobody bugged us, but the team was young and they wanted to grow.”

With the support of the investment group led by Cerberus Capital Management that had backed the creation of Albertsons Cos., Miller and his colleagues embarked on a series of strategic acquisitions. The deal making, which reached a peak in 2015 with the purchase of Safeway and its 1,325 supermarkets, resulted in a company with some 2,300 stores operating under 20 banners across the country.

“At this point I think we’ve got a company that’s here to stay,” Miller remarks. “We know we have to be where customers want to be. We want to be on their favorite corner with the highest-quality fresh, outstanding service and a pleasant shopping environment, but we also want to be there when they want to pick up their groceries or have them delivered to their home or office.”

Miller, who throughout his career has demonstrated the knack for capitalizing on emerging opportunities in the marketplace, adds that Albertsons Cos. is well positioned for further expansion. “The next five to 10 years will be very interesting,” he says. “There are a lot of regional players out there that are going to have a tough time keeping up with the need to invest in technology and other things. Our company has the talent, resources and capital to help them significantly.”

You must be logged in to post a comment Login